Ethereum and Solana investors know the script: rapid rails, smart contracts, dev ecosystems. Lately, though, another story is attracting capital — one that links crypto exposure to something concrete and accessible: real estate.

Avalon X (AVLX) is a presale that connects blockchain finance with Grupo Avalon’s pipeline of projects, and that rational lean is having minds reeling in the ETH and SOL crowds who are hungry for expansion and something more concrete than unadulterated market emotion.

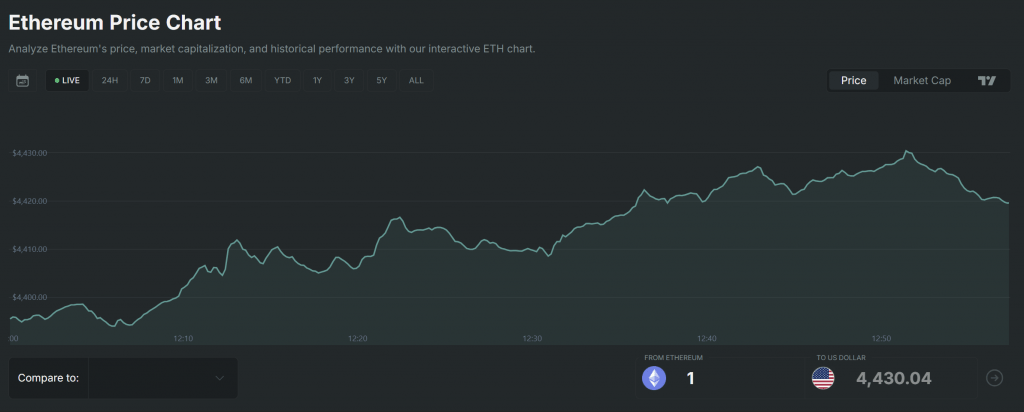

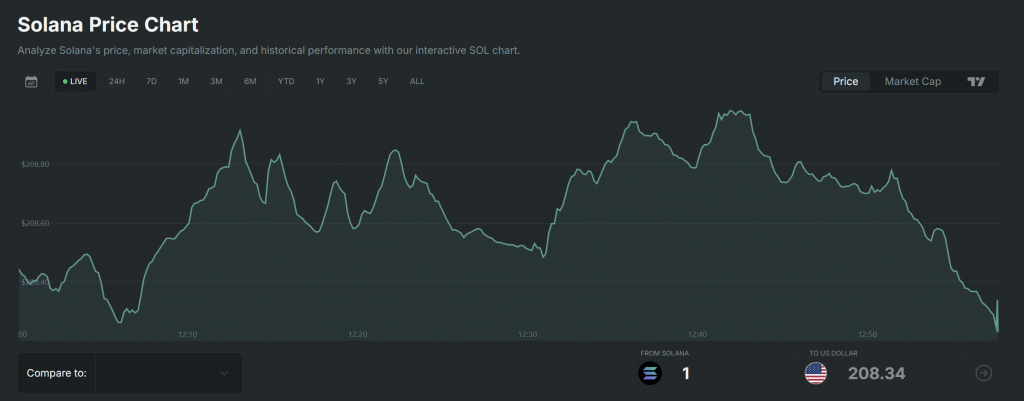

Market overview: Where ETH and SOL Currently Stand

Ethereum price stands at $4,371.95, down by 0.09% (1d), with a market cap of $527.78B and a volume of nearly $34.94B (up 23.4%).

Source: Tradingview

Solana stands at $202.16, up 2.17% (1d), with a market cap of $109.36B and a volume of $6.72B (up 20.39%).

Source: Tradingview

Those numbers represent two things: movement and liquidity. ETH users see more volatility as traders rebalance, while SOL communities seek speed and on-chain returns. Both groups are asking: can we maintain upside with restricted exposure to headline swings? For many, Avalon X seems to be the solution.

From Smart Contracts To Hard Assets: How Avalon X Works For Investors

Avalon X (AVLX) isn’t trying to supplant blockchains — it’s trying to bring a new toolset. The tokenization platform tokenizes access to real estate developments so that economic exposure and ownership can be represented on-chain.

That means without needing to tap local markets or possess massive capital, retail investors and institutions can access global high end real estate through a more tradable and transferable digital token.

Tokenization here is beneficial: it reduces old-fashioned friction (long forms, bank wires, geographic constraints) and provides more liquid access to value. For on-chain dynamics-savvy traders like ETH and SOL, the concept is second nature — this time only the underlying asset is a condo or townhouse rather than a DeFi pool.

Grupo Avalon: On-The-Ground Credibility Is Paramount

What makes Avalon X different from another presale idea is the builder. Grupo Avalon’s local operations there have a good track record — $110 million worth of closed sales, a pipeline of active projects, and a pipeline of projects that brings the platform close to a billion dollars worth of project value. That helps solve one of the biggest tokenized real estate uncertainties: whether or not the actual projects get built, sold, and leased.

To investors who are already comfortable with code, the added peace of mind of knowing an actual, experienced dev stands behind it is extremely appealing. It’s not a whitepaper promise — it’s projects with addresses, contractors, and cashflow potential.

Trust, Transparency, And Investor Security

Transparency and trust are Avalon X’s top priorities. With smart contracts audited and verified by CertiK, Avalon X introduces a security approach unheard of in presales, where control is usually relaxed. For investors in ETH and SOL who are wary of hype launches, this audit assures them that the platform prioritizes investor security over hype.

Apart from technical validation, presale commits tokens to utility and lifestyle: reduced accommodation prices, advance reservation, concierge-level benefits, and other concrete real-world perks that give token ownership substance, not esotericness.

The project’s banner $1 million giveaway and a prize deeded townhouse in the gated Eco Avalon development have also whipped up interest — but importantly, these incentives are founded on the same real-asset narrative and not marketing hype.

Why ETH And SOL Users Might Cycle — But Not Lose Chain Exposure

It’s not about selling Solana and Ethereum and fleeing layer-1s. Rather, it is about rebalancing: investors require some component of their portfolio to remain as liquid, protocol-native bets and the remainder to acquire exposure to permanent, income-generating assets. Avalon X offers a middle ground — programmable ownership, in-chain liquidity, and direct access to real estate where value is less susceptible to hourly social whims.

Simply stated: ETH and SOL give you the rails and composability. Avalon X gives you bricks and mortar, but accessed through the rails you’re already using. For customers that are tired of such unadulterated hype cycles, that mix is more attractive.

The Next Step For Curious Investors

If you’re an ETH or SOL holder thinking about diversification, Avalon X is worth a look — not as a replacement for protocol bets, but as a complement that aims to blend growth with stability. The presale is live with AVLX tokens priced at $0.005 in Stage 1, and the project emphasizes developer credibility, contract audits, and real-world benefits rather than empty promises.

Join the Community

Website: https://avalonx.io

$1M Giveaway: https://avalonx.io/giveaway

Telegram: https://t.me/avlxofficial

X: https://x.com/AvalonXOfficial

Disclaimer: This is a sponsored article. The views and opinions presented in this article do not necessarily reflect the views of CoinCheckUp. The content of this article should not be considered as investment advice. Always do your own research before deciding to buy, sell or transfer any crypto assets.