Santiment’s latest analysis shows that on-chain metrics and social sentiment are successfully flagging crypto turning points, from XRP’s peak to Cardano’s bottom.

Summary

- Santiment reports crypto sentiment has flipped to fear across the market.

- Whale activity signaled XRP’s top, while fear marked Cardano’s price bottom.

- Weak U.S. data fueled Fed rate cut bets, driving risk-off trading behavior.

Bitcoin diverges from traditional markets

On-chain data is proving effective at identifying market turning points. Whale activity successfully pinpointed XRP’s recent peak, and extreme crowd fear correctly signaled Cardano’s price bottom.

As Fed rate cut speculation drives investor behavior, Bitcoin (BTC) and traditional markets have diverged in an unusual pattern: stocks edge higher while BTC lags.

This has created an unusual gap between the assets that historically move together.

This divergence could present an opportunity if historical patterns hold. When such gaps appear, Bitcoin often catches up to stock market performance. This suggests potential upside if the traditional correlation reasserts itself.

Bitcoin’s Network Realized Profit/Loss metric recently spiked during the price decline. This shows healthy capitulation and profit-taking behavior.

Meanwhile, social media sentiment hit extreme negativity just as tokens like DANO began rallying—a textbook contrarian signal. With traders abandoning smaller altcoins for established cryptocurrencies, the current environment may be setting the stage for strategic buying opportunities among the assets most feared by the crowd.

Contrarian signals emerge in altcoin markets

Cardano provided a textbook example of contrarian sentiment signaling. The token’s price began rallying precisely when social media sentiment hit extreme negative levels.

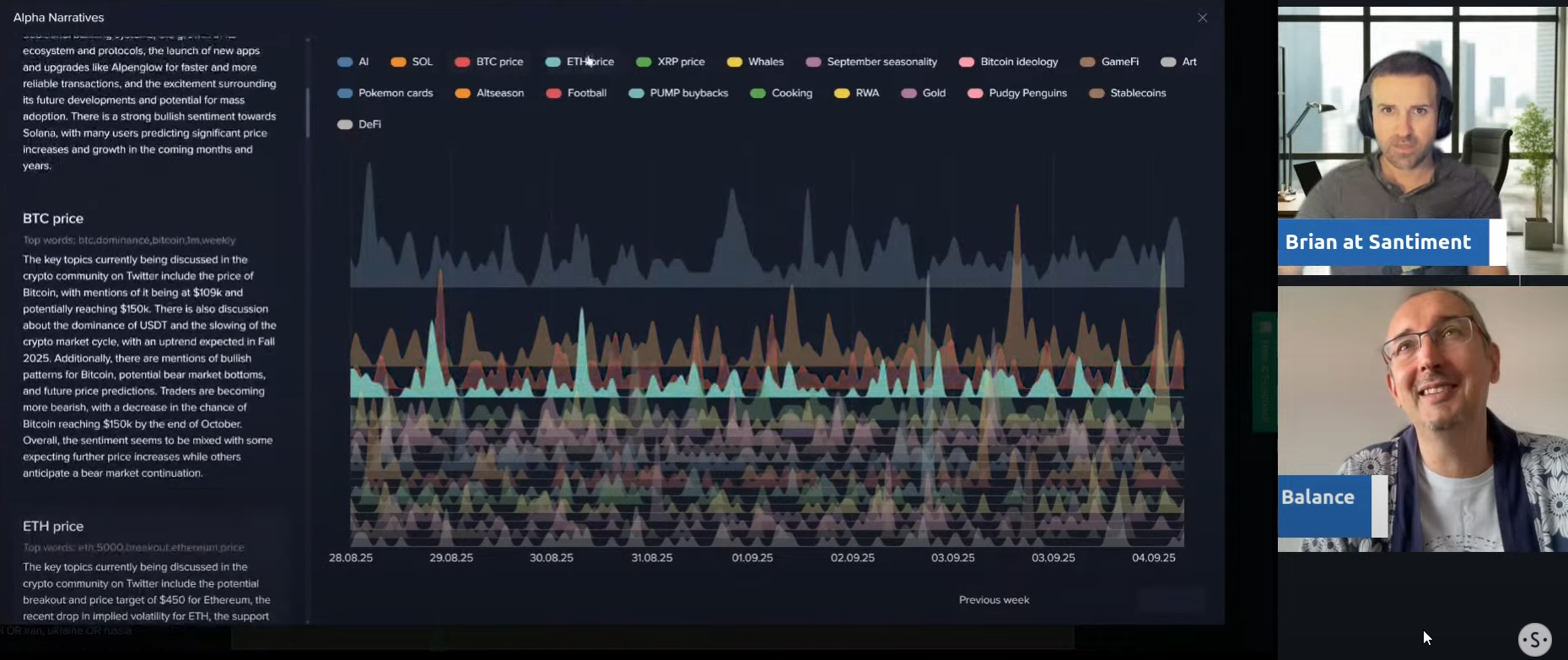

Santiment analysis of social narratives shows that the crypto community is focused on large-cap crypto. They also concluded that traders are less interested in obscure altcoins.

This pattern shows the market situation where extreme fear creates buying opportunities for contrarian investors.

The current environment suggests that while fear dominates headlines and smaller altcoins struggle, these conditions may be setting up future opportunities.

Investors monitoring sentiment extremes and on-chain metrics may find value in assets where crowd pessimism has reached peak levels.

The shift away from smaller altcoins toward established cryptocurrencies shows the flight-to-quality behavior typical during uncertain market periods.