Key Notes

- XRP rose 3%, breaching the $2.9 mark on Sunday, September 7, second only to DOGE among top 10 crypto gainers.

- Speculation builds as SEC deadlines for XRP ETF filings approach between October 18 and 25.

- Futures activity confirms leveraged demand driving XRP’s price moves despite weaker spot market volumes.

Ripple (XRP) rose 3% on Sunday, September 7, emerging as the second-best intraday performer among the top 10 cryptocurrencies behind Dogecoin (DOGE), which bounced 4%. Community discussions over the past 24 hours suggest both assets benefited from increased speculation around pending Cryptocurrency ETF reviews as the SEC approaches a critical October 18 decision window.

🚨 XRP SPOT ETF COUNTDOWN 🚨

Starting Oct 18, 2025, Grayscale, 21Shares, Bitwise & more await the SEC’s decision. ⚡️

👉 One approval could change XRP forever. 🚀#XRP #CryptoETF #BullRun pic.twitter.com/oq7qLD65XR

— GC (@AlphaTradesFX) September 7, 2025

Echoing many other active influencers within the Ripple army online community, analyst AlphaTrades posted an image showing key deadline dates on the XRP ETF filings by seven asset managers, all anticipated in seven days between October 18 and October 25.

Ripple (XRP) Price Rises 3% on Sunday, September 7, 2025, with trading volume down 10% | Source: CoinMarketCap

XRP trading metrics on Sunday reflects the 3% price uptick was mainly driven by active high-leverage speculative demand. As seen on the CoinMarketCap chart above, XRP price 3% rally on Sunday was accompanied by a 10.3% decline in 24 hour trading volume. Such a significant price increase during a decline in spot market activity signals that the main catalyst lies among traders speculating on future events.

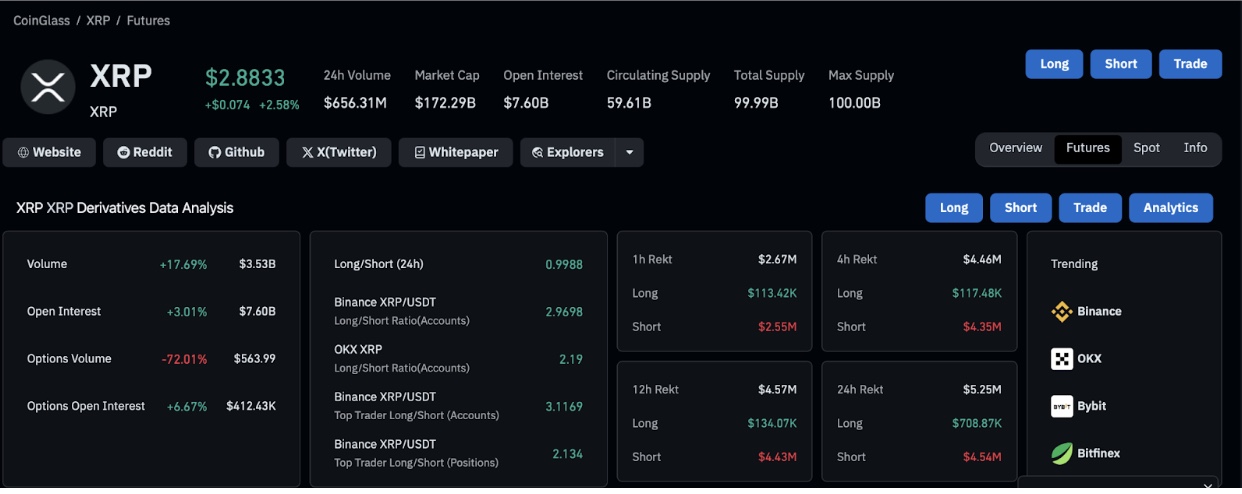

Ripple (XRP) Derivatives Market Analysis | Source: Coinglass, September 7, 2025

Confirming this narrative, Coinglass’ derivatives data shows XRP futures trading volume rose 17% with open interest, which tracks the value of new XRP futures positions created over the last 24 hours increased by 3%, aligning with the daily timeframe XRP price increase.

If the rising speculative demand persists as the critical ETF deadlines approach, top altcoins like XRP, with seven active filings in review, could continue to outperform spot market headwinds as seen in Sunday trading.

Ripple (XRP) Price Forecast: Can Bulls Push Beyond $3 This Week?

XRP’s technical outlook shows price consolidating near $2.88 after the 3% intraday rally. The Bollinger Bands narrow around $2.70 support and $3.07 resistance, suggesting volatility compression ahead of a breakout.

A bullish scenario would see XRP break above $3.07 resistance, supported by improving RSI momentum, now at 48.3 after bouncing from oversold levels. If bulls push through, the next upside target sits at $3.20, with a longer-term target at $3.45 should ETF speculation intensify.

Ripple (XRP) Technical Analysis | XRPUSDT 24H Chart | TradingView, September 7, 2025

The bearish case points to weakening spot trading activity as a risk factor. With leveraged bull traders overexposed, negative macro catalysts could spark massive liquidation, potentially dragging the XRP price towards the recent local low at $2.70 support. A breakdown below this level risks a sharper retracement toward $2.50, undoing recent gains.

With RSI showing mid-level positioning and a lack of spot demand backing the rally, XRP is likely to trade range-bound below $3, until fresh catalysts emerge. However, high leverage positioning over the weekend confirms expectations of potential sharp moves in either direction this week.

SUBBD Presale Gains Momentum as Ripple Traders Diversify

Ripple’s (XRP) rally has coincided with renewed attention on new token launches, with SUBBD ($SUBBD) drawing significant market interest. The newly-launched AI-powered platform for content creators, has attracted traction with innovative features combining creator-fan engagement with real utility.

SUBBD Presale

Currently priced at $0.05625, the SUBBD presale has raised $1.05 million of its $1.26 million target, with limited discounted tiers remaining. Prospective investors can still secure SUBBD tokens directly through the official website before the presale cap is reached.

next

Disclaimer: Coinspeaker is committed to providing unbiased and transparent reporting. This article aims to deliver accurate and timely information but should not be taken as financial or investment advice. Since market conditions can change rapidly, we encourage you to verify information on your own and consult with a professional before making any decisions based on this content.

Ibrahim Ajibade is a seasoned research analyst with a background in supporting various Web3 startups and financial organizations. He earned his undergraduate degree in Economics and is currently studying for a Master’s in Blockchain and Distributed Ledger Technologies at the University of Malta.