September was historically a weak month for Bitcoin, but more recent patterns suggest otherwise. Since 2023, Bitcoin’s Septembers have been green, and this one looks to be following the new trend.

BTC is up over 2% since the beginning of the month, and based on upcoming macroeconomic catalysts, plus a breakout on the price chart, it appears that this is only going to continue throughout the rest of the month.

As Bitcoin shows strength, it sets an exciting precedent for the broader crypto market. Historical data show that if Bitcoin ends September with gains, it can produce substantial returns in Q4, paving the way for a significant rally in the altcoin market.

With that in mind, let’s examine the four best cryptos to buy now. We will analyze trends that could have the most influence in the coming months and potentially lead to market-leading gains.

Bitcoin is Breaking its September Curse With 2% Gain

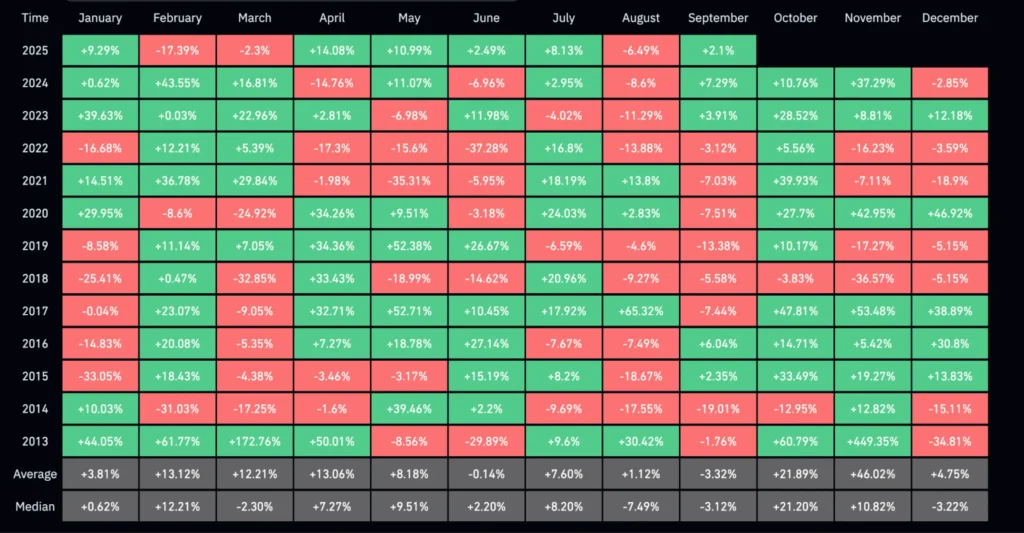

CoinGlass data shows that Bitcoin has been red in eight out of 12 Septembers since its price was first tracked in 2013. Seasonality effects have played a big role in this, but the tide appears to be turning.

It gained 3.9% in September 2023 following an SEC ruling that laid the groundwork for spot Bitcoin ETFs. Then, in September 2024, the US Federal Reserve cut interest rates for the first time since 2020, resulting in a 7.29% gain for Bitcoin.

This year, macroeconomic factors such as a rising M2 money supply and over a 99% chance of an interest rate hike at the upcoming September FOMC meeting are contributing to a bullish outlook for Bitcoin and fueling its 2% gain.

Popular crypto analyst Cas Abbe commented on Bitcoin’s September outlook, noting there has been a price chart breakout and forecasting that it will steadily increase throughout the month. However, he doesn’t anticipate that the gains will be explosive due to the historically challenging nature of September.

“I’m expecting a slow move towards $114K-$115K in the coming weeks. September has historically been bearish for BTC, so a new ATH is definitely not expected.”

He continued, “But IMO, BTC could close September in the green just like 2024.”

And with the upcoming Q4 being Bitcoin’s strongest fiscal quarter, a rally in September could lay the way for big gains as the year ends. So, what are the best cryptocurrencies to capitalize on this momentum?

Best Wallet Token

Imagine being able to swap any cryptocurrency across more than 50 blockchains, always getting the best market price, without needing to use a centralized exchange. You could maintain self-custody of your funds the entire time, and don’t need KYC verification – Best Wallet Token is bringing this vision to reality.

It’s developing a multi-chain crypto wallet that supports Bitcoin, Ethereum, XRP, Cardano, and many other blockchains.

Best Wallet also supports fiat on- and off-ramping and even offers its own crypto debit card. It’s one of the first use cases that seamlessly blends decentralized finance (DeFi) with traditional monetary systems.

The project also features a presale aggregator, an NFT gallery, a staking aggregator, and much more. And right now, BEST is undergoing a presale, allowing investors to purchase early. The presale has already raised $15 million, reflecting massive investor support.

With such a compelling use case and its early stage, it’s clear why Best Wallet Token could see significant gains in Q4. Visit Best Wallet Token.

Solana

Solana is the leading layer 1 blockchain by active users, with 57 million people interacting with the network this month. It utilizes a unique consensus mechanism called Proof-of-History, which enables it to process thousands of transactions per second, making it suitable for use cases that would be impossible on many other blockchains.

The network is well-known for its meme coin and NFT ecosystems, but it’s now rapidly expanding. More institutional-focused applications are emerging, with Galaxy Digital making history as the first company to tokenize its Class A stocks on Solana. This represents the first instance of a U.S. publicly traded equity being available in its native form on a major public blockchain.

Collector Crypt’s app also recently launched on Solana, allowing users to send real-world collectible goods to their warehouse for tokenization. Additionally, a new Solana-based privacy protocol, Privacy Cash, launched this week and generated over $2 million in revenue within its first hours.

Thanks to its fast speeds, Solana is quietly becoming the preferred network for a wide range of innovative applications – and its price could soon reflect that.

PEPENODE

PEPENODE is a new Ethereum-based mini-game that simulates the crypto mining experience and allows users to earn real meme coin rewards. The concept removes the usual constraints of traditional mining, such as expensive hardware and overhead costs, technical expertise requirements, loud noise, and storage, replacing them with an engaging virtual economy.

Users start with an empty server room and use PEPENODE tokens to buy Miner Nodes and upgrade them. Combining different Miner Nodes will achieve varying outputs of mining power, adding a strategic element to the game.

A whopping 70% of funds spent on nodes and upgrades will be burned, creating deflationary pressure that encourages the PEPENODE price to grow over time. This mix of token utility and deflation – along with its rewards and Pepe-themed meme appeal – is why PEPENODE might be the best crypto to buy.

It’s also in a presale and has raised over $700,000 in its opening days, showing strong early momentum. Since the presale is still in its early stages, investors have a chance to buy early and potentially reap significant gains. Visit PEPENODE.

World Liberty Financial

World Liberty Financial is a new cryptocurrency launched by a Donald Trump-affiliated DeFi project called World Liberty Financial. The WLFI token is used for governance, giving holders a vote on protocol decisions.

This year, the project launched a stablecoin called USD1, which has gained significant popularity. Recently, it was involved in a $2 billion deal connected to Binance through Abu Dhabi’s MGX fund.

WLFI’s blend of political branding and DeFi positions it as both a financial experiment and a cultural statement, drawing considerable investment with a market cap of $5.4 billion.

Despite a pullback after its launch, the WLFI price has now begun to stabilize and has increased 6% in the last 24 hours, a sign that launch volatility is giving way to steady investor accumulation. With that, we could well see the WLFI price begin to rally in the weeks ahead, especially if Bitcoin rises.