The company secured 14.02 EH/s of computing power and protection from US tariffs on China-made mining hardware. While the tariffs aim to boost domestic manufacturing, critics warn they could raise equipment costs, weaken demand from US miners, and ultimately drive mining operations back overseas.

American Bitcoin Expands with Bitmain Deal

American Bitcoin, a Bitcoin mining company backed by members of US President Donald Trump’s family, exercised an option to acquire up to 17,280 application-specific integrated circuits (ASICs) from Bitmain, which is one of the world’s leading crypto mining hardware manufacturers. Earlier this month, the company purchased 16,299 Antminer U3S21EXPH units, which deliver a combined computing power of 14.02 exahashes per second/ The deal was worth around $314 million, according to TheMinerMag.

(Source: TheMinerMag)

The main goal of the agreement is to shield American Bitcoin from price hikes that could result from the Trump administration’s sweeping trade tariffs and import duties on China-made Bitmain equipment.

In anticipation of these tariffs, Bitmain announced plans to open its first US-based ASIC production facility by the end of the year, as well as a new headquarters in either Florida or Texas. The trade restrictions are part of a push to reshore manufacturing, but they have introduced new strains across the Bitcoin mining supply chain. Miners and hardware producers are both being forced to adjust their strategies as they navigate the shifting economics brought on by the tariffs.

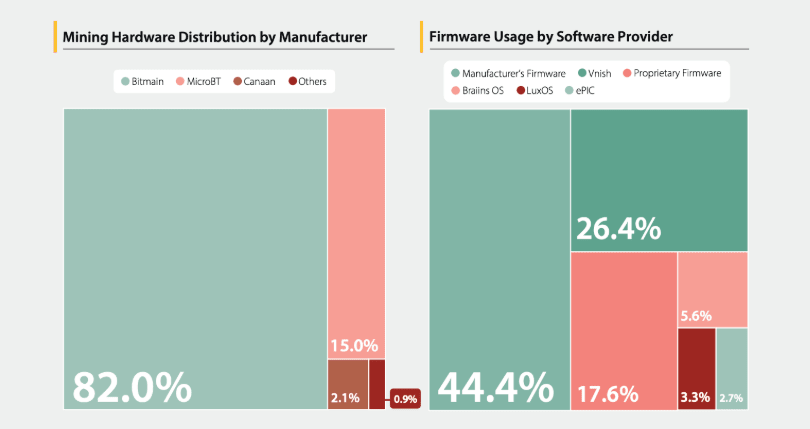

Currently, over 99% of global Bitcoin mining hardware comes from three companies — Bitmain, MicroBT, and Canaan — with Bitmain holding a dominant 82% market share, according to the University of Cambridge. While the administration’s strategy is to bring production to US soil, it has attracted some mixed reactions.

Mining hardware distribution by manufacturer (Source: University of Cambridge)

Critics argue that the tariffs could be inflationary and ultimately harm the domestic mining industry. Jaran Mellerud, CEO of Hashlabs, warned that higher equipment prices might crush demand from US miners, leaving manufacturers with excess inventory to offload abroad at lower prices. Such a shift could reverse the intended goal by pushing mining operations back overseas, and eroding the competitive position of US-based miners.